The barriers to Best Execution for Corporates

Best execution is one of the most commonly used terms in foreign exchange (FX) and across other financial markets.

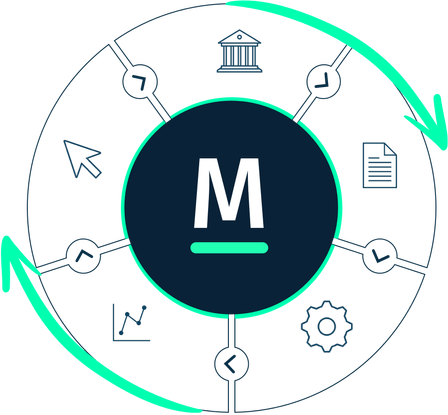

Our independent FX-as-a-Service is an easily integrated fixed-fee service model for corporate finance teams, which helps to centralise FX operations and automate trade and settlement workflows, whilst significantly reducing FX execution and hedging costs.

We are not a bank, market maker,

venue or brokerage.

We are independent

tech-enabled, and transparent.

Trades are executed in an agency capacity across up to 15 Tier 1 banks.

We connect directly into your workstation.

We integrate directly into your depository to auto-instruct FX payments.

We independently audit FX execution costs.

Click-to-trade or file-upload for auto-execution.

Are you suffering under lack of transparency of your FX pricing? In our latest Corporate FX research report, we lifted the hood on some of the biggest issues in the FX market, offering a unique window into corporates’ views on FX, how they’re adapting their FX risk management practices and their priorities in the year ahead.

Best execution is one of the most commonly used terms in foreign exchange (FX) and across other financial markets.

A new report from FX-as-a-Service pioneer, MillTechFX, has found that recent currency volatility is ramping up pressure on senior-finance decision makers at corporates...

Inflation has seemingly become the word of the day, reaching a 40 year high of 9% in the UK in June. Meanwhile, the IMF has reduced its forecast...

Simply fill in both fields below and one of our friendly experts will be in touch shortly to discuss your requirements.