The Netherlands is a founding member of the European Union and was one of the first countries to adopt the euro on 1 January 1999, when it became a euro-area member.

The dual circulation period, when both the Dutch guilder and the euro had legal tender status, ended on 28 January 2002, drawing to a close the use of the guilder, which had been legal tender in the Netherlands since 1434.

The euro steadily grew to a peak of 1.6 euros to the dollar in 2008, before entering a gradual decline following the financial crisis.

The euro now generally sits around 1.1 euro to the dollar, however, it has experienced significant volatility in recent years. Notably in 2022, the currency’s value dropped below the dollar for the first time since 2000.

Being a founding member of the EU, it is perhaps no surprise that the Netherlands relies heavily on intra-European trade. In fact, trade within the bloc accounts for 66% of the Netherlands’ exports and 42% of imports.

MillTechFX recently surveyed 250 fund managers across Europe to find out more about their FX set up, risk management, hedging programmes and journey towards automation.

From the research, it’s clear that currency management is top of mind for fund managers in the Netherlands.

In this blog, we will take you through the findings in relation to fund managers in the Netherlands including their FX exposure, pain points, hedging strategies and priorities.

The importance of FX for Dutch fund managers

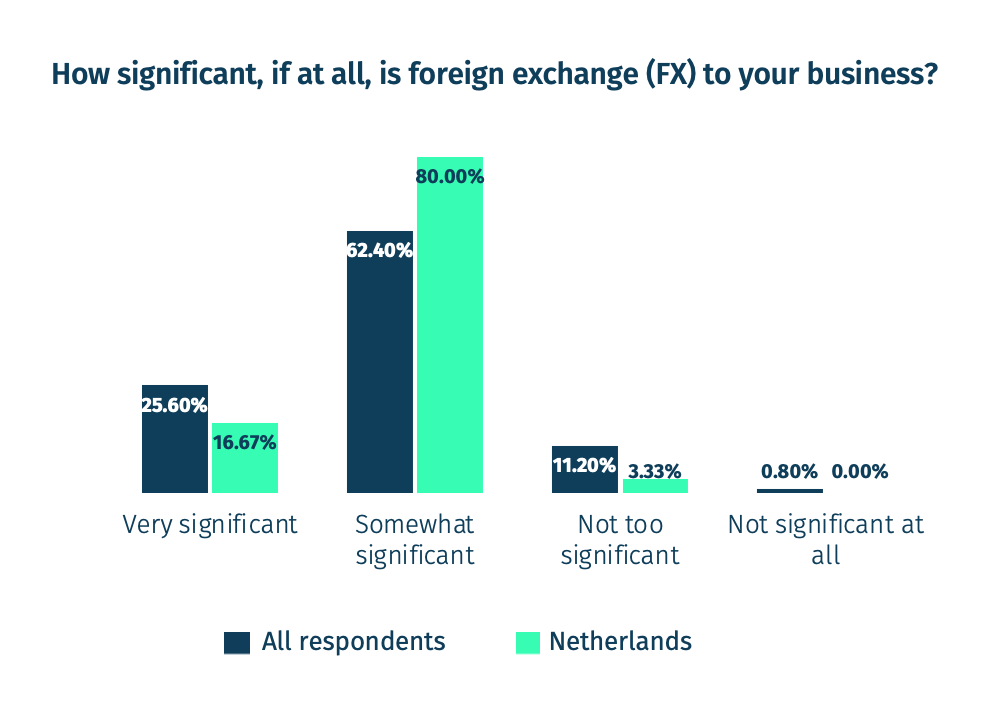

- Dutch fund managers consider FX to be of greater importance than the rest of Europe with 97% saying FX was significant to their business, compared to the European average of 88%.

- All fund managers surveyed in the Netherlands (100%) stated that their returns have been affected by euro volatility, well above the European average of 89%.

- 50-59% of Dutch fund managers’ business is exposed to foreign currencies, highlighting the significance of FX to their business.

Increased automation interest amongst FX fund managers

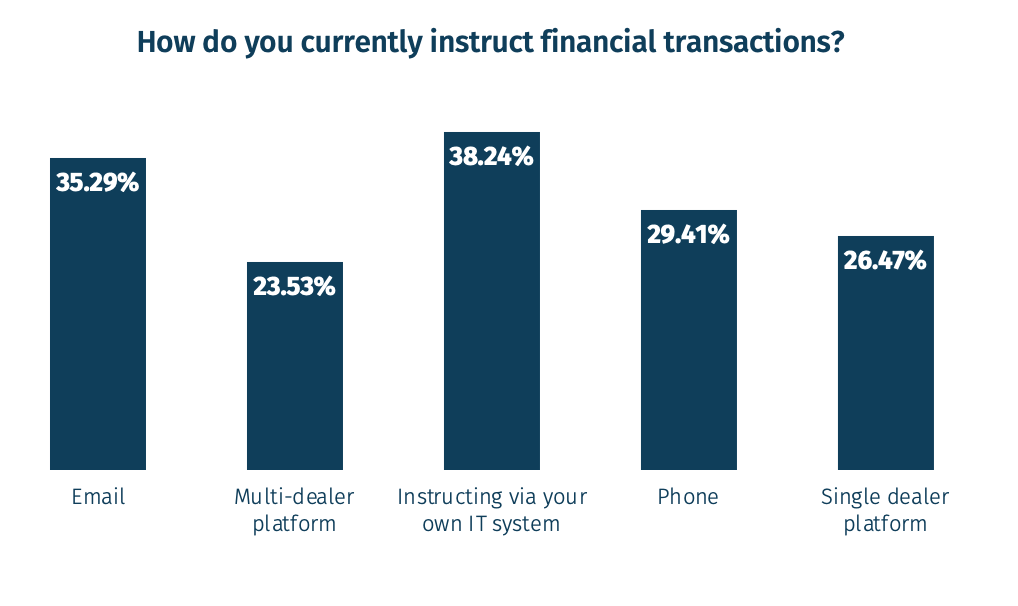

Our research revealed that fund managers in the Netherlands still rely heavily on manual processes for FX execution:

- 40% of fund managers rely on email to instruct financial transactions and 37% rely on phone calls.

- On average, fund managers in the Netherlands have nearly three team members tasked with FX activities and spend over two days per week on FX-related matters.

- The biggest challenge for Dutch fund managers is manual processes (37%).

- The vast majority of Dutch fund managers (93%) are looking into new technology and platforms to automate their FX operations.

- This puts them ahead of the rest of European fund managers, 87% of which are exploring automation.

Dutch fund managers suffer from a lack of transparency in the FX market

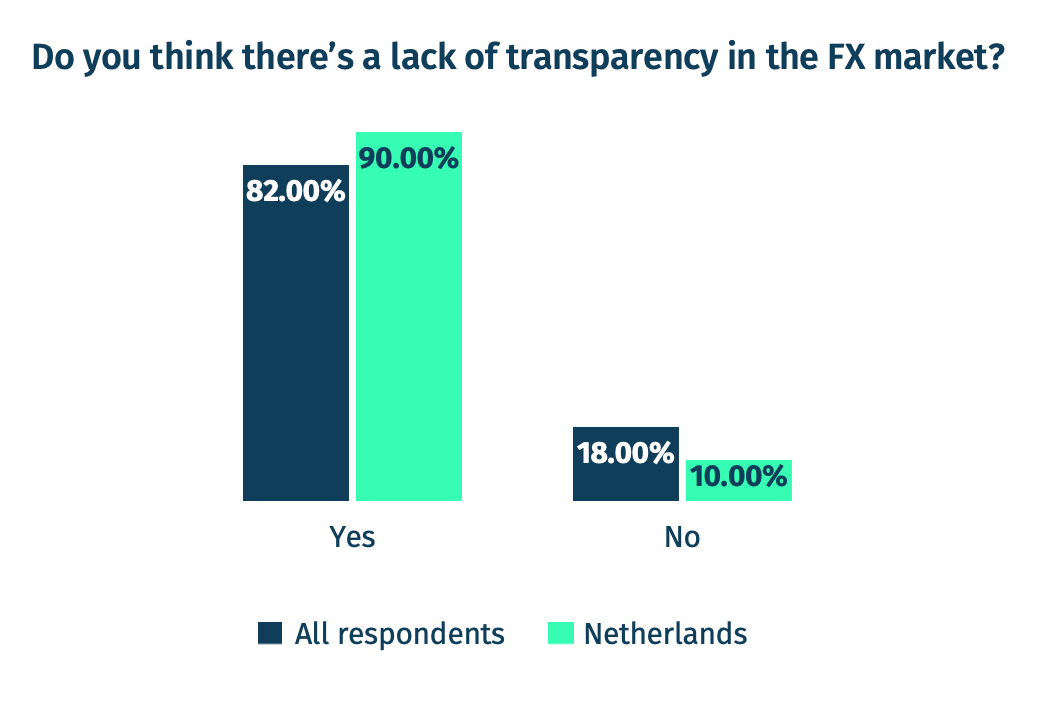

We asked fund managers if they thought there was a lack of transparency in the FX market:

- The answer was a resounding yes, with over four-fifths (82%) of respondents saying so.

- It was even more resounding in the Netherlands, where 90% of fund managers stated they thought there was a lack of transparency in the FX market.

Hedging trends in the Netherlands

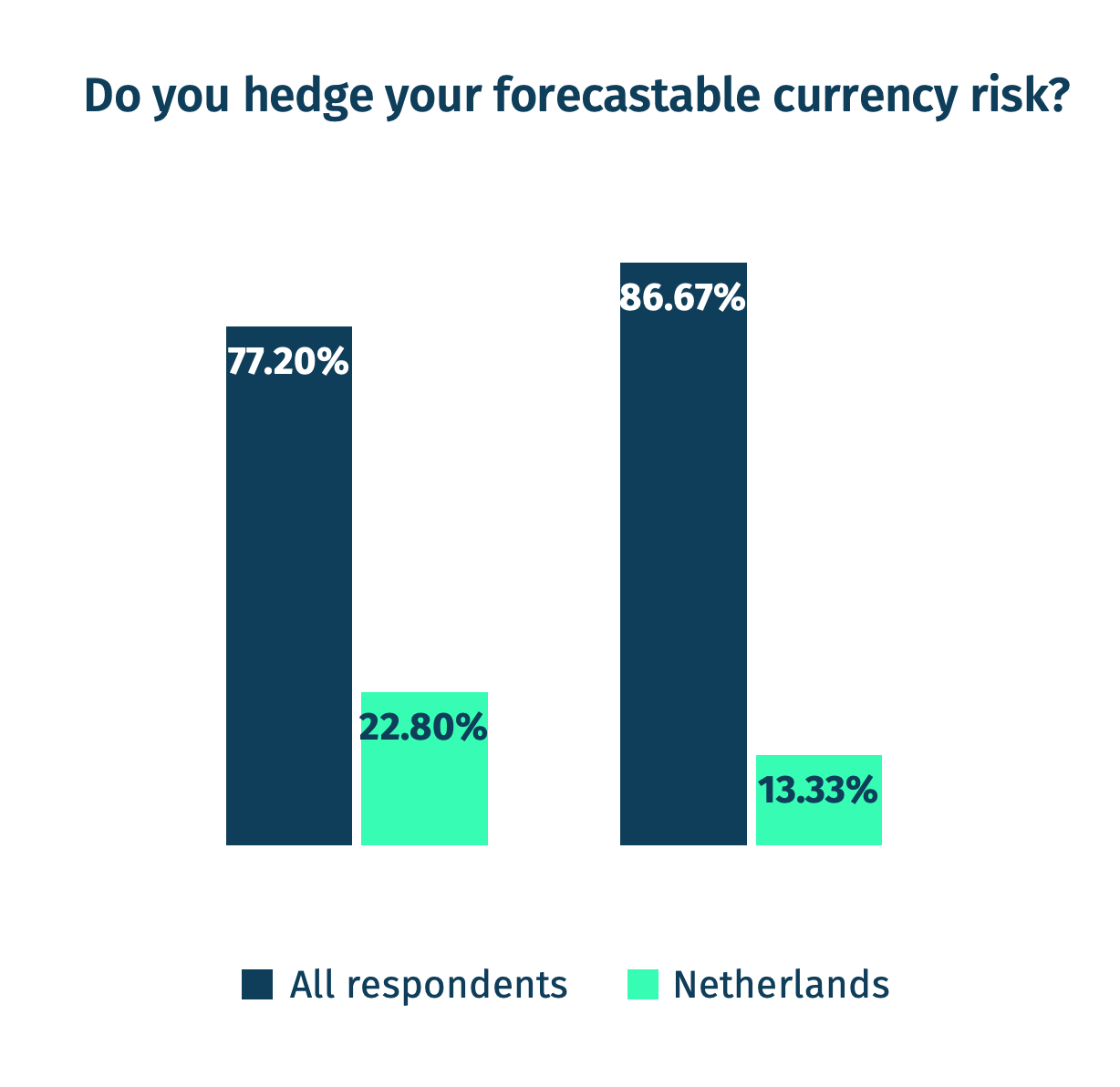

Given that 100% of fund managers in the Netherlands said their returns were impacted by EUR volatility, it’s perhaps unsurprising that the vast majority hedge their risk:

- 87% hedge their forecastable risk

- 100% of those that don’t are now considering hedging given market volatility

- This is higher than the European averages of 77% and 88%, respectively.

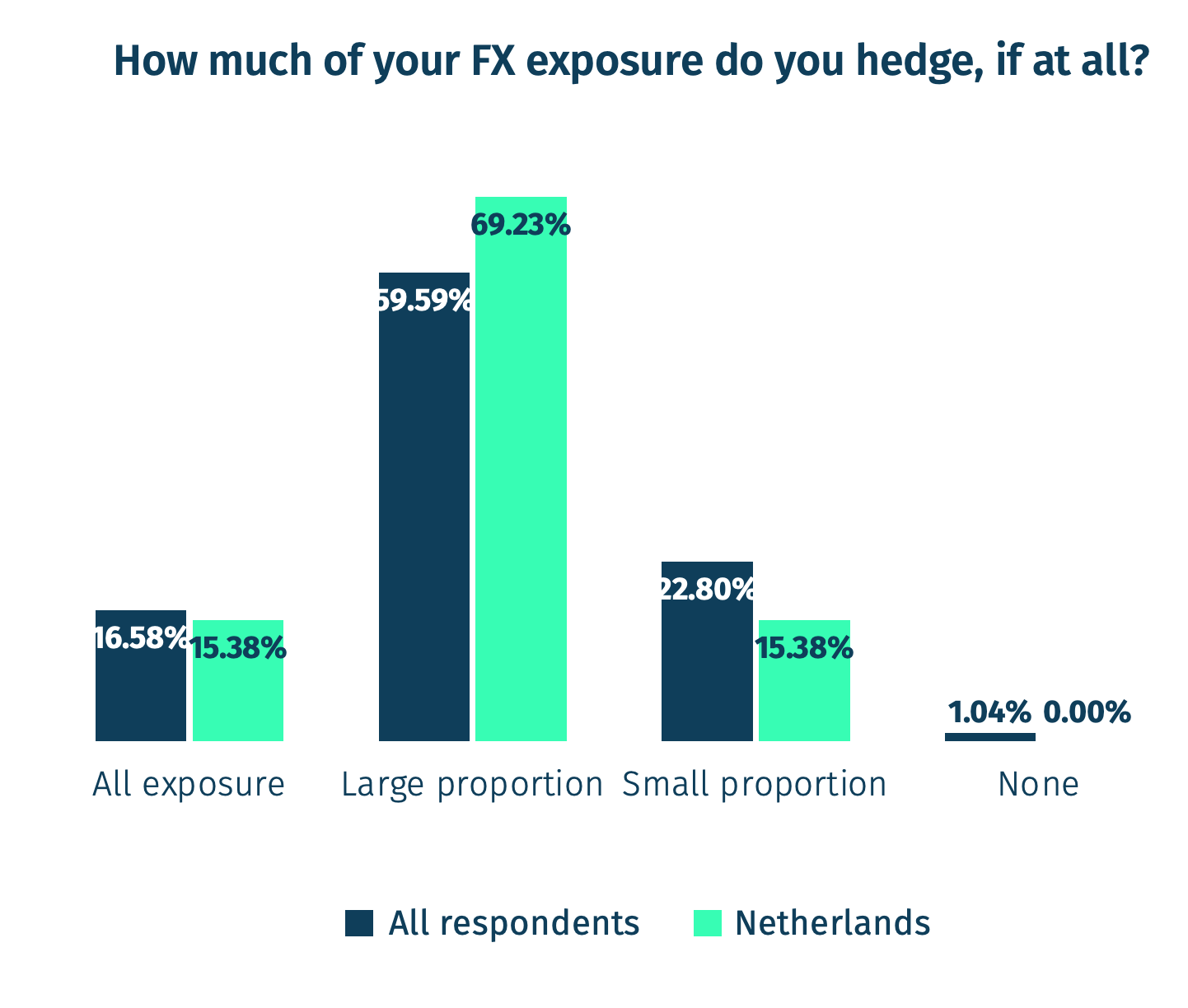

- 15% of fund managers in the Netherlands reported that they hedge all of their FX exposure, with 69% stating that they hedge a large proportion.

- This is broadly in line with the rest of Europe, which reported 17% and 60% respectively.

- Dutch fund managers reported an average hedge ratio of 50-59% and 62% stated their hedge ratio is higher than the previous year.

- This is in line with their European counterparts, with 61% of fund managers surveyed reporting their hedge ratio increased from last year.

FX counterparty risk is a priority in the Netherlands

The banking crisis in 2023 sent shockwaves throughout the finance industry. In Switzerland, a globally systemic bank stood on the brink, for the first time since Lehman Brothers and in the US, three regional and specialised banks failed in rapid sequence.

Whilst the banking sector has seemingly stabilised since the turmoil of Spring 2023, many senior finance decision-makers at European fund managers are taking lessons from the crisis on board.

- Our research found that 90% of fund managers in the Netherlands are looking to diversify their FX counterparties, the same proportion as the rest of Europe.

The importance of Environmental, Social and Governance (ESG)

Driven by increased pressure from investors, governments and consumers, ESG criteria are now central to the decision-making process for many fund managers. Our survey found that the trend has also begun to play an increasingly important role in selecting FX counterparties and service providers.

- This was highest in the Netherlands, with 100% of fund managers responding that ESG credentials impact their selection of FX counterparties

- 63% say it impacts their decision to a great extent.

FX should be a key priority for Dutch fund managers in 2024

With uncertainty set to stay, we believe the management of FX currency risk should be considered a top priority for Dutch fund managers in the year ahead.

Fortunately, there are several ways they can improve their FX risk management infrastructure and protect their returns in these uncertain times:

- Transaction cost analysis (TCA) – TCA was specifically created to highlight hidden costs and enables fund managers to understand how much they are being charged for the execution of their FX transactions. Ongoing, quarterly TCA from an independent TCA provider can be embedded as a new operational practice to ensure consistent FX execution performance.

- Outsourcing– There is a growing recognition that outsourcing does not necessarily mean a loss of control, less transparency or reduced quality of FX activities, but when using the right partner outsourcing can improve transparency and execution quality. Outsourcing can therefore enable fund managers to dedicate more time to core business matters, which is all the more important amidst inflationary and volatility pressures.

- Strong governance – FX is one of the largest and most liquid markets in the world, but also one of the most complex. Setting up and onboarding new FX counterparties, centralising price discovery and navigating the post-execution phase require a team of people and often have their own complications. Harnessing solutions which can enhance transparency and governance can help fund managers improve the cost, quality and transparency of their FX execution.

- Comparing the market - We believe that fund managers should seek alternatives to the traditional single bank-based approach. Instead, they should look for solutions that enable them access to live rates from multiple banks and execute at the best rate, all whilst reducing the operational burden traditionally associated with this kind of market access.

- Diversification of liquidity providers – Recent events in the banking sector show that reliance on one or two counterparties can be an extremely risky strategy, as the loss of a major FX counterparty could render firms unable to trade. We believe fund managers should begin exploring technology-driven alternatives to the single bank-based approach that enable them to transact in FX in a way that addresses risks associated with a single point of failure.

- Automation – Despite the rising threat of currency movements, many fund managers continue to rely on manual processes like phone and email to execute FX trades which may make it harder to mitigate the impact of currency volatility. Harnessing automated solutions can offer end-to-end workflow, greater transparency and faster onboarding, helping finance departments streamline their FX functions.

How MillTech FX can help

MillTechFX is an FX-as-a-Service (FXaaS) pioneer that enables fund managers to access multi-bank FX rates via an independent marketplace.

MillTechFX’s market access, pricing power and operational resource enable it to deliver a tech-enabled integrated solution that delivers transparency, cost reduction and operational burden reduction for senior finance decision-makers at fund managers.

It is end-to-end at no additional cost, offering easy and quick onboarding, multi-bank best execution and hedging management, and connectivity into clients’ bank accounts, internal systems, administrators or custodians.

To speak to us directly please reach out to our EU sales team on eusalesdesk@milltechfx.com or request a free TCA here.

Download full report here.

This blog post examines & refers to the data and results of a survey by Censuswide on MillTechFX’s behalf conducted between 10 November and 27 November 2023 based on a survey of 250 senior finance decision-makers at mid-sized asset management firms in Europe (described as those with assets under management ranging from €500m to €20b). The full survey can be found here.