Despite its small size, Luxembourg has developed into a European financial hub and, having listed the world’s first green bond, has a particularly strong reputation surrounding green finance. The country’s finance sector accounts for 25% of its GDP, and it is also Europe's largest investment fund centre (the second largest in the world).

As a founding member of the European Union, Luxembourg is one of only 11 countries that first adopted the euro, in place of the Luxembourgian franc.

As such, the country has witnessed the entirety of the currency’s history, including the value height of 1.6 EUR to 1 USD in 2008 and its gradual decline to roughly 1.1 EUR to the dollar. Geopolitical and economic instability have brought increased levels of volatility for the euro in recent years, with the currency’s value dropping below the dollar for the first time in 2022.

Being a small country in the heart of Western Europe, Luxembourg relies on the European Union for roughly 90% of its trade. This makes the country and its fund managers extremely dependent on the euro and vulnerable to its fluctuations.

MillTechFX recently surveyed 250 senior finance decision-makers at fund managers across Europe to gain insight into how different countries operate FX resourcing, risk management and hedging strategies.

The report shows us that FX management is a top priority for fund managers in Luxembourg. This blog delves into the research’s insights into Luxembourgian fund managers’ FX risk management, including their FX exposure, pain points, hedging strategies and priorities.

FX has strong significance for Luxembourg's fund managers

- Our research found that 93% of fund managers in Luxembourg said that FX was significant to their business, higher than the European average of 88%.

- It also found that 93% of fund managers in Luxembourg said their returns had been affected by EUR volatility, higher than the average of 89%.

- Interestingly, 60% of Luxembourg fund managers’ business activity is exposed to foreign currency risk. This was the highest of any European country surveyed, and nine percentage points higher than the average of 51%, demonstrating the importance of FX to fund managers in the country.

- Despite its importance, 85% of fund managers in Luxembourg struggle with a lack of FX transparency. This proportion was higher than the European average, demonstrating that this could be a more pressing issue for them.

Strong appetite for FX automation hasn't translated into action

When it comes to using manual processes to instruct FX-related activity, Luxembourg still has work to do in moving towards more efficient automated processes.

- An average of 2.5 days a week are spent on FX-related activities by fund managers in Luxembourg

- 9 people per team are tasked with FX activities, one of the highest figures in Europe, second only to Belgium at 3.1.

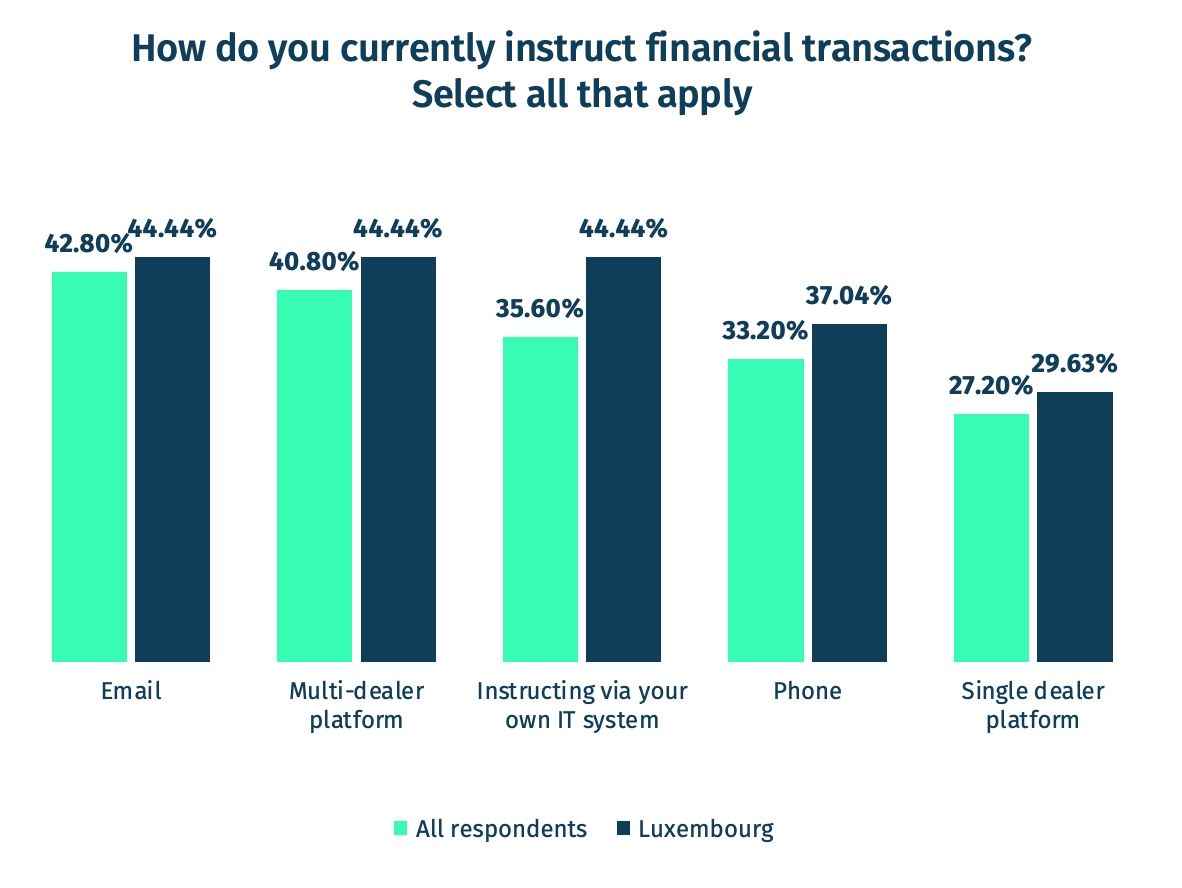

Luxembourg fund managers’ reliance on phones and email was also higher than the European average:

- 44% still instructing financial transactions over email

- 37% doing so over the phone.

Such manual processes are a burden on human capital for fund managers and significantly reduce the efficiency of foreign exchange activity.

- The good news is that 93% of fund managers in Luxembourg are looking into new technology and platforms to automate their FX operations.

- This was one of the highest figures in Europe and above the 87% average.

Hedging trends in Luxembourg

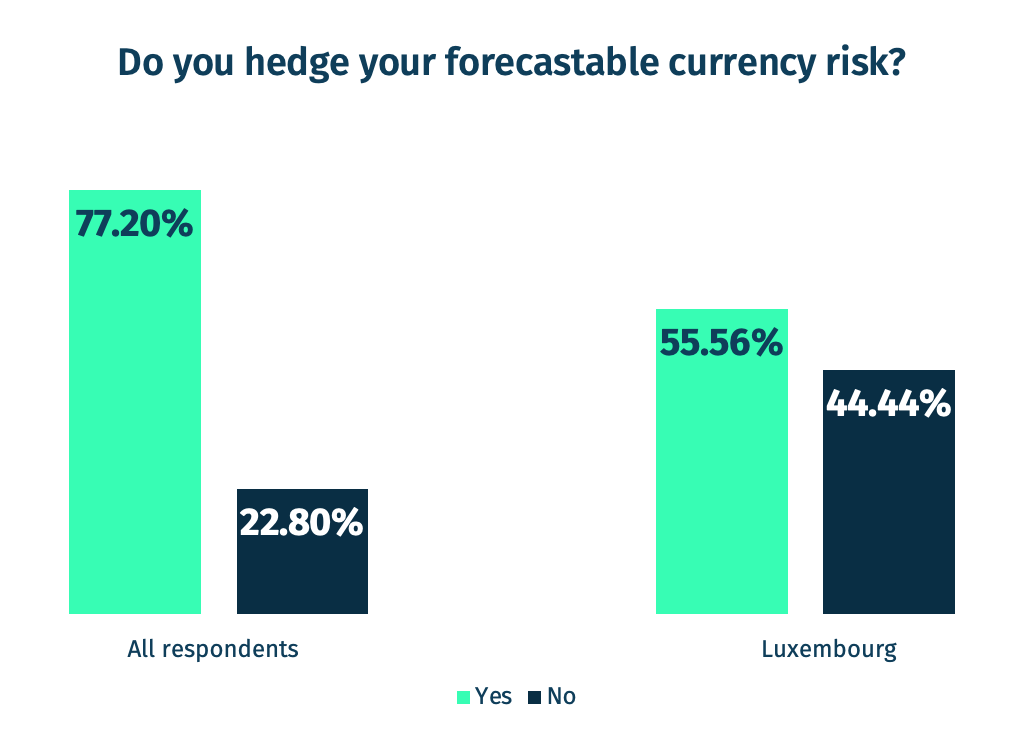

- Although 93% of fund managers in Luxembourg said their returns had been impacted by EUR volatility, surprisingly the country had the lowest proportion of fund managers that hedge their forecastable currency risk (56%), far below the European average of 77%.

- However, the report discovered that 87% hedge all or a large proportion of their FX exposure, the second highest in Europe. They also have a relatively high average hedge ratio of 63%, the highest in the group, while 60% said that this was higher than the previous year.

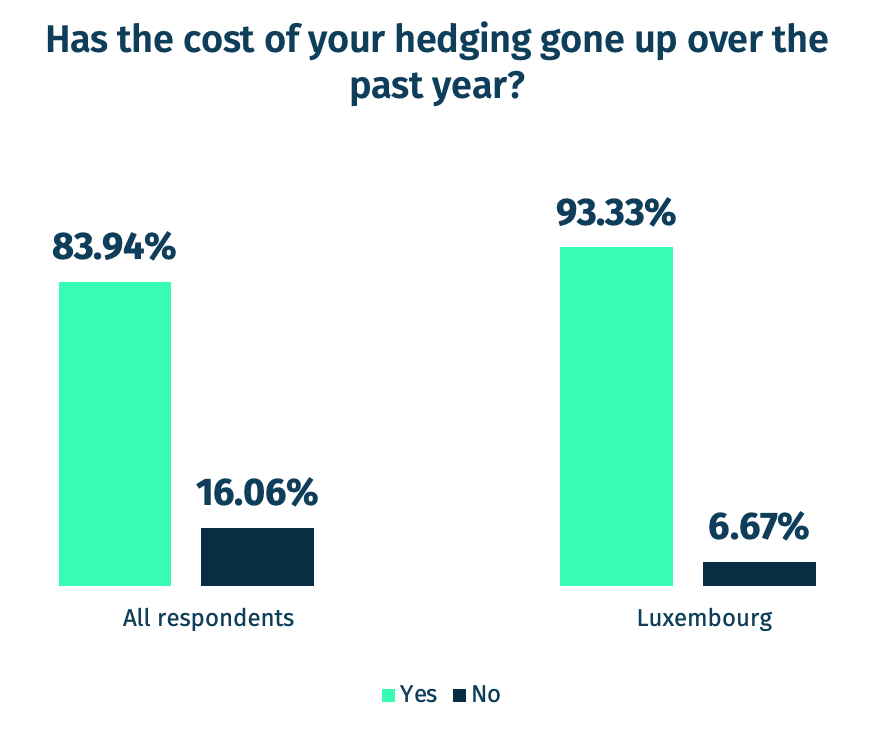

- The majority of fund managers across Europe stated that their hedging costs had increased over the last year.

- However, Luxembourg’s fund managers felt it more than others, may have risen with 93% reporting them to be higher. This was the second highest in the group, behind the Netherlands (100%), and significantly above the 84% European average

Luxembourg's need to diversify FX counterparties

The banking crisis in 2023 sent shockwaves throughout the finance industry. Credit Suisse, a globally systemic bank, stood on the brink for the first time since Lehman Brothers and, in the US, three regional and specialised banks failed in rapid sequence.

Whilst the banking sector has seemingly stabilised since the turmoil of Spring 2023, many senior finance decision-makers at European fund managers are taking lessons from the crisis on board.

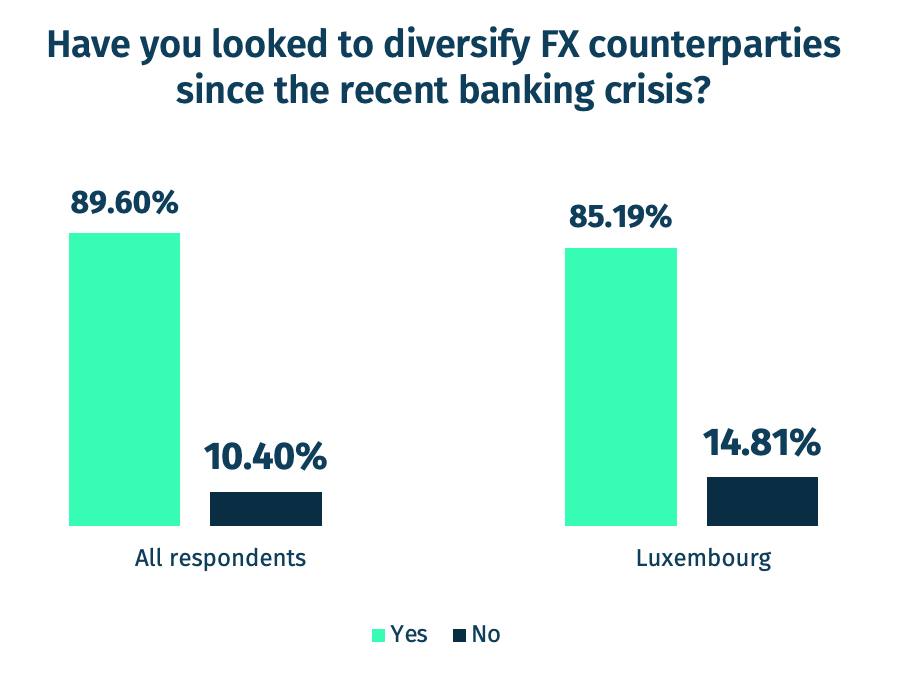

- Our research found that 90% of European fund managers are looking to diversify their FX counterparties.

- A healthy 85% of fund managers in Luxembourg said they were exploring counterparty diversification, but this was one of the lowest proportions in Europe.

Luxembourg prioritses ESG

Driven by increased pressure from investors, governments and consumers, ESG criteria are now central to the decision-making process for many fund managers.

- Our survey found that 94% of European fund managers said that ESG credentials impact their selection of FX counterparties, while 56% said they have a big impact.

- Luxembourg had the highest percentage of fund managers that said ESG credentials impacted FX counterparty selection to a great extent (67%), which is unsurprising given its reputation as a green finance hub.

FX should be a key priority for Luxembourg’s fund managers in 2024

With uncertainty set to stay, we believe the management of FX currency risk should be considered a top priority for fund managers in Luxembourg in the year ahead.

Fortunately, there are several ways they can improve their FX risk management infrastructure and protect their returns in these uncertain times:

- Transaction cost analysis (TCA) – TCA was specifically created to highlight hidden costs and enable fund managers to understand how much they are being charged for the execution of their FX transactions. Ongoing, quarterly TCA from an independent TCA provider can be embedded as a new operational practice to ensure consistent FX execution performance.

- Comparing the market – We believe that fund managers should seek alternatives to the traditional single bank-based approach. Instead, they should look for solutions that enable them access to live rates from multiple banks and execute at the best rate, all whilst reducing the operational burden traditionally associated with this kind of market access.

- Outsourcing – There is a growing recognition that outsourcing does not necessarily mean a loss of control, less transparency or reduced quality of FX activities, but when using the right partner outsourcing can improve transparency and execution quality. Outsourcing can therefore enable fund managers to dedicate more time to core business matters, which is all the more important amidst inflationary and volatility pressures.

- Strong governance – FX is one of the largest and most liquid markets in the world, but also one of the most complex. Setting up and onboarding new FX counterparties, centralising price discovery and navigating the post-execution phase require a team of people and often have their own complications. Harnessing solutions which can enhance transparency and governance can help fund managers improve the cost, quality and transparency of their FX execution.

- Diversification of liquidity providers – Recent events in the banking sector show that reliance on one or two counterparties can be an extremely risky strategy, as the loss of a major FX counterparty could render firms unable to trade. We believe fund managers should begin exploring technology-driven alternatives to the single bank-based approach that enable them to transact in FX in a way that addresses risks associated with a single point of failure.

- Automation – Despite the rising threat of currency movements, many fund managers continue to rely on manual processes like phone and email to execute FX trades which may make it harder to mitigate the impact of currency volatility. Harnessing automated solutions can offer end-to-end workflow, greater transparency and faster onboarding, helping finance departments streamline their FX functions.

How MillTech FX can help

MillTechFX is an FX-as-a-Service (FXaaS) pioneer that enables fund managers to access multi-bank FX rates via an independent marketplace.

MillTechFX’s market access, pricing power and operational resource enable it to deliver a tech-enabled integrated solution that delivers transparency, cost reduction and operational burden reduction for senior finance decision-makers at fund managers.

It is end-to-end at no additional cost, offering easy and quick onboarding, multi-bank best execution and hedging management, and connectivity into clients’ bank accounts, internal systems, administrators or custodians.

To speak to us directly please reach out to our EU sales team at eusalesdesk@milltechfx.com, phone number +33 1 88 24 98 90, or request a free TCA here.

Download the full report here.

This blog post examines & refers to the data and results of a survey by Censuswide on MillTechFX’s behalf conducted between 10 November and 27 November 2023 based on a survey of 250 senior finance decision-makers at mid-sized asset management firms in Europe (described as those with assets under management ranging from €500m to €20b). The full survey can be found here.